How 爱屋吉屋 goes from unicorn to bankruptcy

In February 2019, news of 爱屋吉屋 (iwujiwu) bankruptcy hits the wire.

爱屋吉屋 (iwujiwu), was once regarded as the fastest growing unicorn in China. It prides itself as the online platform that will disrupt brick-and-mortar real estate companies in China. A market that is strongly held by 链家 (LianJia) and 中原地产(Zhongyuan).

爱屋吉屋 rode on the rising trend of the O2O playbook and is most remembered as they became a “unicorn” through 4 rounds of fundraising US$1B in just 273 days. By the 13th month, they close their fifth and Series E raising US$350M from many well known VCs.

They are also well known for inviting famous actress 蔡明 (Cai Ming) to endorse their platform. Their promise land is a 1% sales charge vs 2% from the brick and mortar competitors.

Just like their meteoric rise, their fall was just as quick when the lights go out.

How 爱屋吉屋 challenges the incumbents

For many brick-and-mortar businesses, the failure to transform could mean a slow spiralling path to extinction. Yet, if one embarks on a path to transform, it could lead the organization onto a quick path to death.

Such is the mentality when new O2O players enter the market. Their approach, mindset, business model threatens the incumbents from all angles.

爱屋吉屋 believes that the incumbents are charging high fees, providing poor service, and opaque information leading to ill-informed choices for renting and buying of resale housing.

They believe that they can change the heavy asset model of the incumbent through the Internet. With the Internet platform, they will be able to reduce cost and make the process of renting or buy properties efficient and as transparent as possible.

Worth noting is in 2014, 爱屋吉屋 captured 28% of the Shanghai rental market, and by May 2015, it’s resale housing market became third in Shanghai, second only to Lianjia and Zhongyuan. In September the same year, it surpassed Zhongyuan and sold more than 2,400 properties in the second-hand housing market. Lianjia led with 4,000 units sales during the same period.

All these through aggressive marketing of their 1% low commission advertising and burning cash to capture the market. However, if you one is to take a long term view of the market, such a model is not sustainable; it negates the basic principles that a business needs health cash flow and profit to sustain in the long run.

Ultimately, the hard decisions of closing office space, retrenchments, and raising the commission charges had to be made in order to save the company.

How bad is their cash flow? Or is it how to “burn money”?

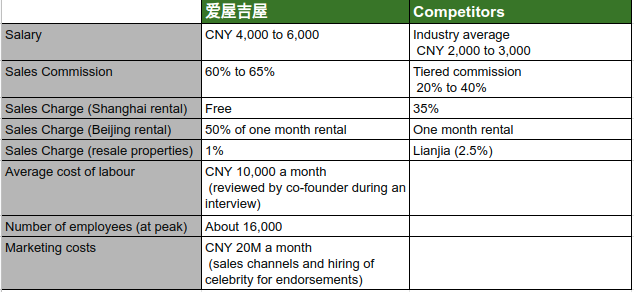

At its peak, 爱屋吉屋 hired about 16,000 employees.

Cashflow issues #1:

To motivate their sales staff, 爱屋吉屋 raises the sales commission to as high as 65% vs the industry norm of 20% to 40%.

At the same time, while competitors are collecting sales charge at 2.5% 爱屋吉屋 cut theirs to 1% to gain market share.

Assuming that their revenue is around CNY400M, outgoing sales commission payable to staff will be at least CNY200M.

Cashflow issues #2:

The industry salary for property agent is around CNY2000 to CNY3000 per month. 爱屋吉屋 paid their CNY4000 to CNY6000.

Assuming an average salary of CNY5000, for a workforce of 16000, 爱屋吉屋 outgoing on salaries will not be less than CNYThe estimated CNY960M per annum.

Cashflow issues #3:

Sales channel. It was reported that 50% of 爱屋吉屋 property listing comes via their advertisements, 30% is generated by the property agents themselves and the last 20% from various other channels.

The spending on advertising is at least CNY200M. Though we have to acknowledge that its early success hinges on their marketing ability as well; capturing 28% of the market share in Shanghai within the first year.

爱屋吉屋 total expenditure is at least CNY1.36B a year with losses no less than CNY1B. The simplistic estimation has not accounted for the cost incurred for the development and maintenance of the platform as well.

Operations and Work Culture

Traditional brick-and-mortar competitors like LianJia, spend time constantly selecting new stores with good locations but also ensuring that the rent is low.

Their property agents are expected to be outside every day. It is common to see them sending leaflets, and working around the neighbourhood community, bus stations, parks, near the malls and any other bustling area. The property agents never leave their offices without their business cards and are constantly combing other listing sites for leads and calling up the leads one by one.

In contrast, 爱屋吉屋 with its new Internet platform provided their agents with a comfortable high basic salary and its heavy budget advertising provided the agents with less need to find leads on their own.

Failure to understand customer needs

爱屋吉屋 fell into the trap of believing that the online platform is going to ‘solve everything’. They believed, a low commission is going to lead to more transactions, and the higher commission charge by traditional incumbents is not what buyers and sellers want.

However, the truth is, when it comes to both the rental and the buyers market, the top priority on the customer’s side is always about finding the ‘right house’. One that meets their needs, and if possible exceed their expectations. Without fulfilling these criteria, it does not matter what the price is and definitely not the sales charge payable.

This is perhaps, one of the most crucial differences between the incumbents and the online platform that 爱屋吉屋 created; having staffs at a physical location listening to the customer requirements from finding the right place, with the right direction, right sizing and right amenities.

As we look back at the fast-growing O2O industry and how startups tried to disrupt the brick-and-mortar, startups need to have more respect for the incumbents. There are insights that cannot be drawn just putting a layer of ‘Internet platform’ as a solution.

爱屋吉屋 was once considered the rising star and a poster child of how O2O can disrupt traditional business. Their spending causes unsustainable damages. But, perhaps, what really defeated them are the hard working property agents who work tirelessly to find the right property for their customers.